What is a Modern Family Office?

The financial landscape is witnessing an unprecedented transformation, heralding the rise of family offices that redefine wealth management for the modern entrepreneur. This evolution signifies a departure from traditional models, previously the domain of the ultra-wealthy, to more inclusive, innovative approaches. Black Mammoth exemplifies this shift, standing as a beacon of progress in the wealth management space. By embracing technology and customized financial strategies, these modern family offices offer a new level of service, tailored to the unique needs and aspirations of today's ambitious individuals. This article aims to demystify the concept of family offices, exploring their evolution, daily operations, and the compelling advantages they offer for comprehensive wealth and legacy management.

What is a Family Office?

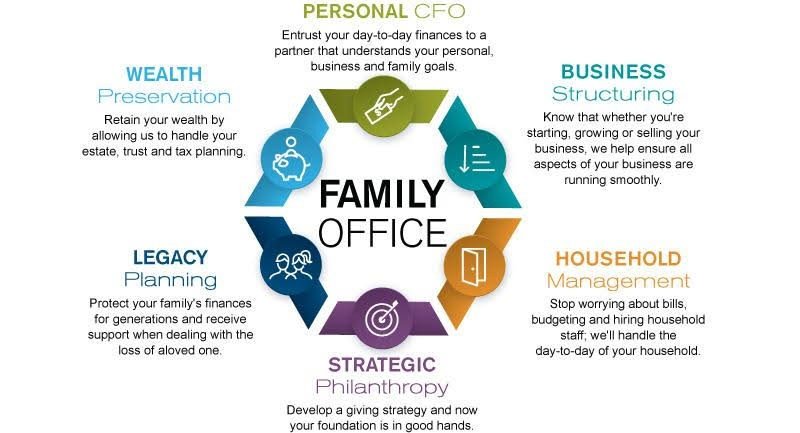

Family offices have historically served as private management hubs for the affluent, overseeing a vast array of personal and financial affairs with utmost discretion. These offices have evolved to provide an extensive range of services beyond mere asset management, encompassing estate planning, philanthropic endeavors, and even coordinating family governance. The essence of a traditional family office lies in its ability to offer bespoke solutions, meticulously crafted to safeguard the wealth and interests of generations. As wealth creation becomes more dynamic, the demand for such personalized, holistic financial oversight has never been greater, prompting a reevaluation of what family offices can offer in the modern era.

What is a Modern Family Office?

Modern family offices represent a seismic shift in wealth management, embracing the complexities of the digital age to serve a new generation of wealth creators. Black Mammoth and similar entities are pioneering this transition, broadening the scope of services to include digital asset management, cybersecurity, and global investment strategies. This modern iteration is not just an evolution in services offered but a reimagining of the family office as a collaborative partner in the client's financial and personal achievements. Through a combination of technological prowess and deep financial expertise, modern family offices are equipped to navigate the multifaceted challenges and opportunities presented in today's global economy.

Daily Operations of a Modern Family Office

The day-to-day functioning of a modern family office is characterized by a dynamic blend of strategic planning, investment management, and personalized client engagement. These entities continuously monitor the financial markets, adapt investment strategies to mitigate risks, and seize growth opportunities. Additionally, they play a crucial role in coordinating with legal advisors, tax professionals, and estate planners to ensure that all aspects of the client's financial life are harmonized towards achieving their long-term goals. This proactive, comprehensive approach to wealth management underscores the modern family office's commitment to not just preserving but enhancing the client's wealth and quality of life.

Why Should I Hire a Family Office?

Engaging a family office is a strategic decision that offers unparalleled advantages for individuals looking to navigate the complexities of wealth management with confidence and foresight. The personalized approach ensures that every financial decision is aligned with the client's life goals, values, and aspirations. Beyond mere financial oversight, a family office acts as a trusted advisor, providing peace of mind and allowing clients to focus on their passions and professional endeavors. For entrepreneurs and high-net-worth individuals, the strategic insights, expertise, and bespoke services offered by a family office are invaluable tools in the pursuit of financial success and legacy building.

Conclusion and Call to Action

In the evolving world of wealth management, the modern family office stands out as a pillar of innovation, offering a tailored approach that resonates with the needs of today's entrepreneurs and wealthy individuals. Black Mammoth's leadership in this space illustrates the potential for personalized wealth management to not only safeguard assets but also to foster growth and legacy creation. For those seeking to chart a course through the complexities of the financial landscape, the choice of a family office partner is pivotal. We invite you to consider the bespoke, forward-thinking services of a modern family office like Black Mammoth as you embark on your journey toward financial mastery and legacy building.