The BNPL Trap: How "Buy Now, Pay Later" Can Sabotage Your Financial Future

Imagine walking into your favorite store, spotting that perfect item you've been eyeing for months, and bringing it home today—without paying a dime upfront. Sounds too good to be true, right? Welcome to the world of "Buy Now, Pay Later" (BNPL), the latest trend in consumer financing that's taking the retail world by storm. But before you jump on the BNPL bandwagon, let's pull back the curtain and explore the hidden risks that could turn your dream purchase into a financial nightmare. These seemingly convenient payment plans offer a seductive proposition, but as the old saying goes, if it seems too good to be true, it probably is.

Raising Money-Smart Kids: A Wealthy Parent's Guide to Generational Wealth

Discover how to prepare your children for inherited wealth. Learn practical strategies for financial education, smart trust planning, and building a family office to secure your legacy.

The Hidden Power of Alternative Investments: Diversifying Your Portfolio Beyond Stocks and Bonds

Explore the world of alternative investments and learn how they can diversify your portfolio and potentially boost your returns.

Beyond Budgeting: Why Emotional Intelligence is the Secret Weapon in Your Financial Arsenal

Discover how emotional intelligence can transform your financial life. Learn strategies to develop this crucial skill for better money management.

Navigating Economic Uncertainty: Strategies for Financial Resilience in Challenging Times

Learn key strategies to build financial resilience during economic uncertainty. Discover how to protect and grow your wealth in challenging times.

The Truth About Financial Advisor Fees: Understanding AUM, Commission, and Flat Fee Models

Discover the pros and cons of AUM, commission, and flat fee models for financial advisors. Learn which structure aligns best with your financial goals.

Demystifying Financial Planning: Why Everyone Needs a Comprehensive Strategy (Not Just the Wealthy)

Learn why comprehensive financial planning is crucial for everyone, regardless of income or net worth, and how to get started.

Mastering Your Money Mindset: The Key to Unlocking True Wealth and Financial Freedom

Discover how your money mindset impacts your financial success and learn strategies to develop a positive relationship with money.

A Black CFP's Guide to Wealth Beyond Dollars

Hey family, it's time we got real about our finances. As a Black CFP, I'm here to tell you that building generational wealth is possible, but it starts with changing our mindset. We've got to stop trying to keep up with the Joneses and start thinking about leaving a legacy. It's not about getting rich quick – it's about making smart decisions with our money. From understanding good debt versus bad debt to starting your legacy with just $100, this guide will show you how to unlock your financial potential and build wealth that lasts for generations.

Embrace the "Win Some, Lose Some" Mindset

Life's a rollercoaster of wins and losses, but success isn't about avoiding the lows—it's about how you handle both. As your CFP®, I'm here to share why "You win some, you lose some, keep moving forward" is my go-to motto. Forget perfection; aim for progress instead. Whether you're celebrating a promotion or dealing with a setback, the key is to learn and keep pushing ahead. By understanding yourself, aligning your actions with your values, and keeping your eyes on the long game, you'll build true wealth—in finances and in life.

Budgeting and Financial Behavior

Let's talk about budgeting, family. I know it sounds boring, but trust me, it's the key to financial freedom. As a Black CFP, I've seen how the right approach to budgeting can change lives. It's not about restriction – it's about aligning your money with what brings you joy. We'll dive into organizing your finances, adding 'fun money' to your budget, and changing those financial behaviors that are holding you back. Remember, true wealth isn't just about dollars – it's about creating a life that brings you joy and security. Ready to master your money?

Teaching Teens Financial Literacy: A Modern Approach to Money Management

In today's digital age, teaching teenagers about money management is more crucial than ever. As a financial advisor at Black Mammoth, I've witnessed the impact of early financial education on young adults' lives. This post explores the challenges of imparting financial wisdom to teens and offers practical solutions. We'll discuss how to overcome our own financial shortcomings, leverage technology to make money concepts relatable, and provide hands-on experiences that bring financial lessons to life. From utilizing apps like Greenlight to implementing a "Tax and Save" system, we'll cover innovative strategies to foster a positive money mindset in your teens. By the end, you'll have a roadmap to empower the next generation with the financial acumen they need to thrive in tomorrow's world.

The Art of Financial Parenting: Nurturing Money-Smart Teens in a Digital Age

Raising financially savvy teenagers is a critical task in our complex economic landscape. As a financial advisor at Black Mammoth, I've guided numerous families through this journey. This post delves into innovative strategies for cultivating financial wisdom in teens, preparing them for a prosperous future. We'll explore how to bridge the financial literacy gap using a combination of modern technology and practical experience. From leveraging digital tools like the Greenlight app to creating a home-based economy, you'll discover effective ways to make money management engaging and relevant for your teens. We'll also discuss introducing investing concepts early and fostering a positive money mindset. By the end, you'll have a comprehensive toolkit for empowering your teens with the financial skills they need to navigate adulthood confidently.

Beyond the Budget: Why Emotional Intelligence is Your Secret Weapon in Wealth Building

Uncover why emotional intelligence is the key to making smarter financial decisions and building lasting wealth.

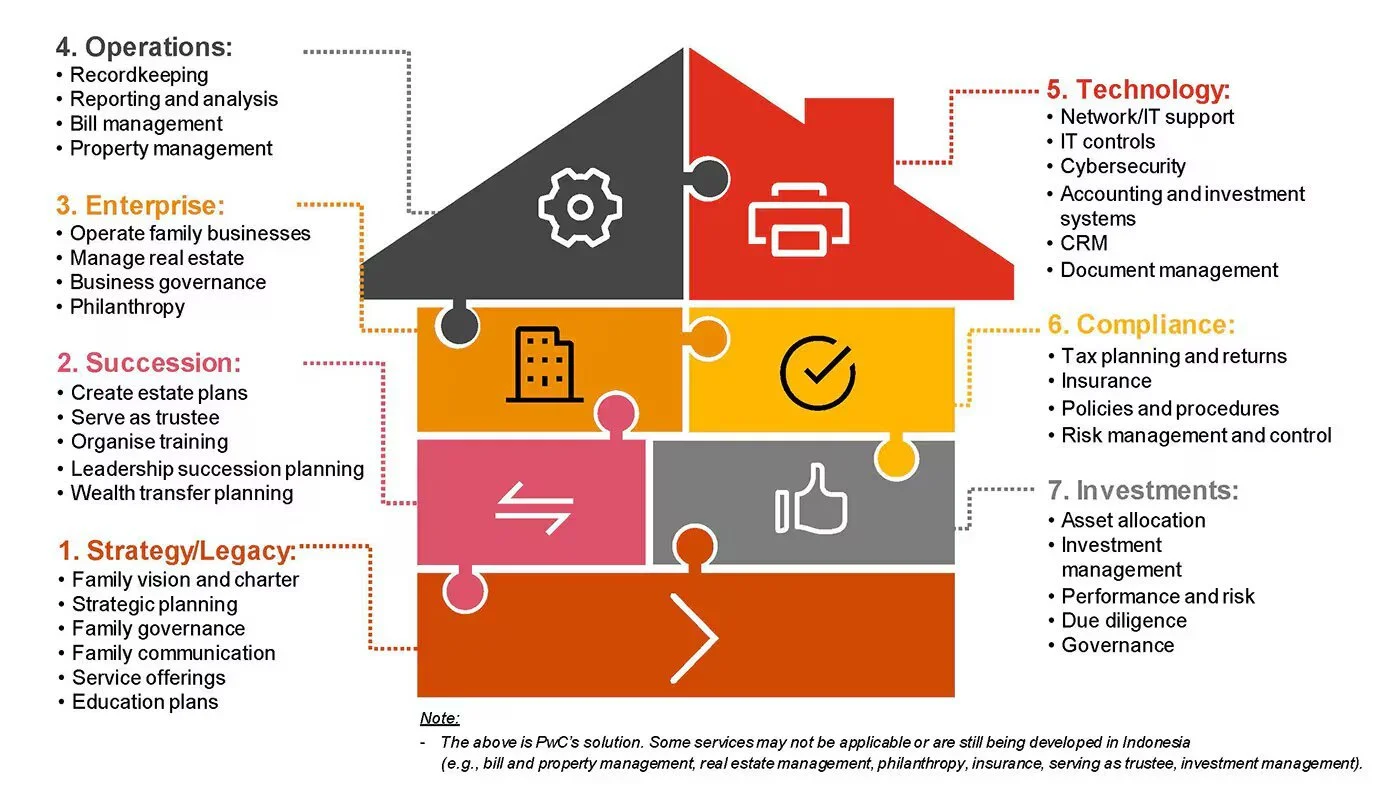

The Modern Family Office: Revolutionizing Wealth Management for Everyday Business Owners

Explore how the Modern Family Office concept is reshaping wealth management for everyday business owners and professionals.

The Athlete's Mindset: Applying Sports Psychology to Your Financial Game Plan

Learn how to apply an athlete's mindset to your finances and achieve your wealth goals with a winning strategy.

Redefining Wealth: Why Your Financial Journey is More Than Just Investment Returns

Discover why wealth is about more than just numbers and how to focus on what truly matters in your financial journey.

Why Being a Business Owner Sucks (And Why It's Still Worth It): Embracing the Challenges of Entrepreneurship

Being a business owner is tough – it's a 24/7 job with endless challenges. From financial stress to decision fatigue, entrepreneurship can be overwhelming. Yet, it's also incredibly rewarding. At Black Mammoth, we understand the paradox of business ownership. It's about embracing the difficulties while reaping the benefits of freedom, personal growth, and the potential to make a real difference. In this post, we explore why being a business owner can be challenging and why it's still worth it. We offer strategies to thrive amidst the chaos and find fulfillment in your entrepreneurial journey.

The True Definition of Wealth: Why Money Isn't Everything and How to Achieve Real Financial Freedom

True wealth isn't about the size of your bank account. It's about finding happiness, giving back to others, and living life on your own terms. At Black Mammoth, we believe in redefining wealth to focus on experiences rather than possessions. This shift in mindset can lead to greater fulfillment and even improved financial health. By understanding your relationship with money, prioritizing what truly matters, and investing in personal growth, you can achieve a richness in life that goes far beyond monetary value. Join us as we explore the three pillars of true wealth and practical steps to achieve real financial freedom.

Breaking the Cycle: Why Financial Education is the Key to Generational Wealth for Black Americans

Financial education is more than just learning how to balance a checkbook or create a budget (although those are important skills). It's about understanding how money works, how to make it work for you, and how to pass that knowledge down to the next generation.

Here's why financial education is crucial:

It Breaks the Cycle of Financial Illiteracy

Many of us grew up in households where money wasn't discussed. Our parents didn't teach us about investing, credit, or building wealth because they didn't know themselves. By educating ourselves, we can break this cycle and ensure our children have the knowledge they need to build wealth.

It Empowers Us to Make Informed Decisions

When you understand how money works, you're less likely to fall for get-rich-quick schemes or predatory financial products. You can make decisions based on knowledge, not fear or misunderstanding.